December Monthly Market Review

- Eloise Bell

- 5 days ago

- 3 min read

Markets ended the year in a holding pattern as central banks cautiously shifted toward supporting growth while inflation pressures continued to ease. December saw the UK and US deliver further interest-rate cuts in response to moderating price trends and softening economic momentum, while the European Central Bank opted to hold policy steady as eurozone inflation stabilised near target. Against this backdrop, market performance was mixed across regions and sectors, with strength in banking, fintech and Asian technology offset by ongoing challenges in parts of emerging markets. Multi-asset portfolios benefited from this balance, navigating subdued equity conditions while remaining positioned for opportunities as 2026 approaches.

Rate Cuts To Support Growth as Inflation Steadies

Rate Cuts Aid Growth: UK and US ease policy as inflation stabilises; ECB remains steady.

Emerging Market Upside: Korea leads gains on tech strength

Sector Leaders: Banking and fintech outperform, while India faces headwinds.

As markets continued to trade sideways in December, the Balanced portfolio returned 0.45%, benefitting from positions in both equity and fixed income.

Inflation and Interest Rates.

UK.

In December 2025, the Bank of England trimmed its base interest rate by 0.25%, from 4.00% to 3.75%, marking its fourth reduction of the year amid easing inflation and weakening economic momentum. Meanwhile, consumer-price inflation has continued to slow: overall CPI dropped to around 3.20% in November, with shop‑price inflation climbing slightly to 0.70% year‑on‑year in December and food-price inflation rising to 3.30%.

U.S. Federal Reserve.

In December 2025, the US Federal Reserve narrowly approved a 0.25% rate cut, the third of the year, lowering the federal funds target range to 3.50–3.75%, though internal divisions suggest further cuts will depend on upcoming data. Meanwhile, headline CPI inflation eased to around 2.70% in November/December — the lowest since mid‑2025, as core inflation slowed to approximately 2.60%. These trends indicate gradually cooling price pressures, providing the Fed with room to pause and assess economic progress moving into 2026.

European Central Bank (ECB).

In December 2025, the ECB left its main interest rates unchanged, maintaining the deposit rate at 2.00% for a fourth consecutive meeting, citing balanced inflation around its 2.00% target and modest economic resilience. Meanwhile, eurozone headline HICP inflation eased to about 2.00–2.10% in November–December, with core inflation steady near 2.40%, reinforcing the view that price pressures are under control.

Market performance.

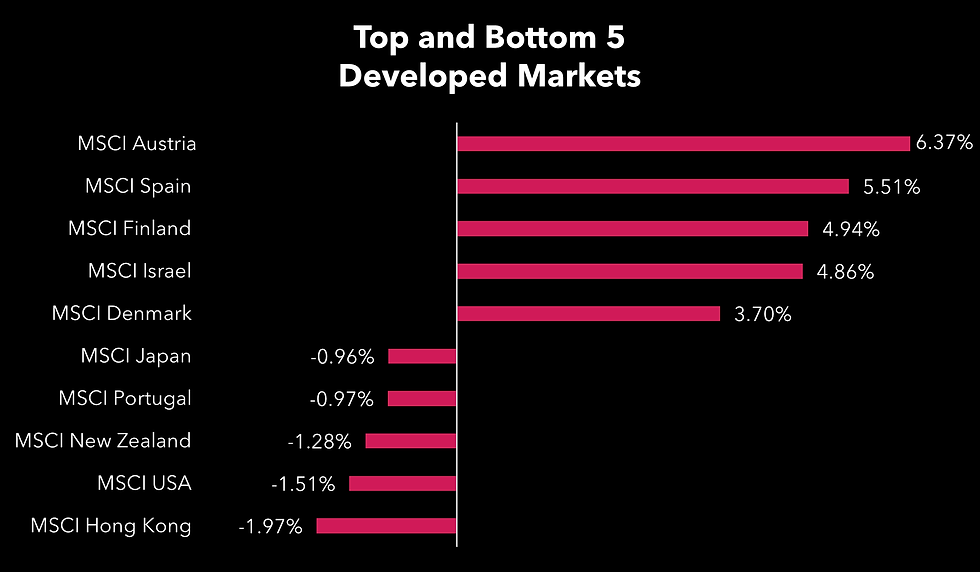

In developed markets, Austria’s market had a strong month (+6.37%), helped by its big banks and energy companies. These sectors benefited from steady European demand and lower energy costs, making Austria one of the best performers.

Hong Kong (-1.97%) struggled due to ongoing weakness in the property market and uncertainty around China’s economy. These factors kept investor sentiment subdued and pulled the market lower.

In Emerging Markets, Korea shone brightest (+11.02%), led by a blockbuster surge in semiconductors (Samsung, SK Hynix) and AI-adjacent industries like energy infrastructure and defence.

Brazil fell almost three percent as political uncertainty and fiscal worries weighed on sentiment, despite low valuations. Investors stayed wary on potential populist policies under President Lula, keeping Brazilian stocks among the weakest in emerging markets.

Sector performance.

At sector level, Banking and fintech stocks led gains in December (+5.00%). Major banks saw share price recovery on rising interest margins, while digital-payments platforms benefited from increased adoption and innovation-focused investor interest.

Indian-focused funds lagged (-2.63%) as India’s benchmark indices saw moderate gains but significantly underperformed other global markets. Weakness in tech and consumer stocks, along with record foreign investor outflows, dragged down regional performance.

Source: FE FundInfo, 06/01/26

Summary.

Global markets closed the year on a steady note, supported by targeted rate cuts and easing inflation trends. The UK and US adopted a more accommodative stance, while the ECB maintained stability as eurozone inflation aligned with its 2.00% target. Emerging markets delivered mixed results, with Korea leading gains on semiconductor strength, while Brazil and China faced ongoing challenges. Sector performance was led by banking and fintech, underscoring resilience and innovation in financial services. Multi-asset portfolios continued to provide balance, cushioning volatility and positioning for opportunities in 2026.

Sources.

The ‘Balanced portfolio benchmark’ is the UT Mixed Investment 20-60% Shares Sector.

Bank of England cuts interest rates to 3.75% - the lowest level since early 2023, bbc.co.uk, 18th December 2025

UK food prices and shop price inflation pick up at end of 2025, survey shows, by Divided Fed approves third rate cut this year, sees slower pace ahead, by CNBC, 10th December 2025

December 2025 Inflation Report, by Tim McMahon, December 19, 2025

European interest rate data from the European Central Bank www.ecb.europa.eu, December 2025