Written by Anthony Walters, Clever’s Head of ESG, this monthly market review offers insights into the most notable and impactful events in global financial markets over the last month.

- A mixed month for markets

- Volatile banks, now with liquidity support

- Organisation of the Petroleum Exporting Countries (OPEC+) cuts oil production, spiking price

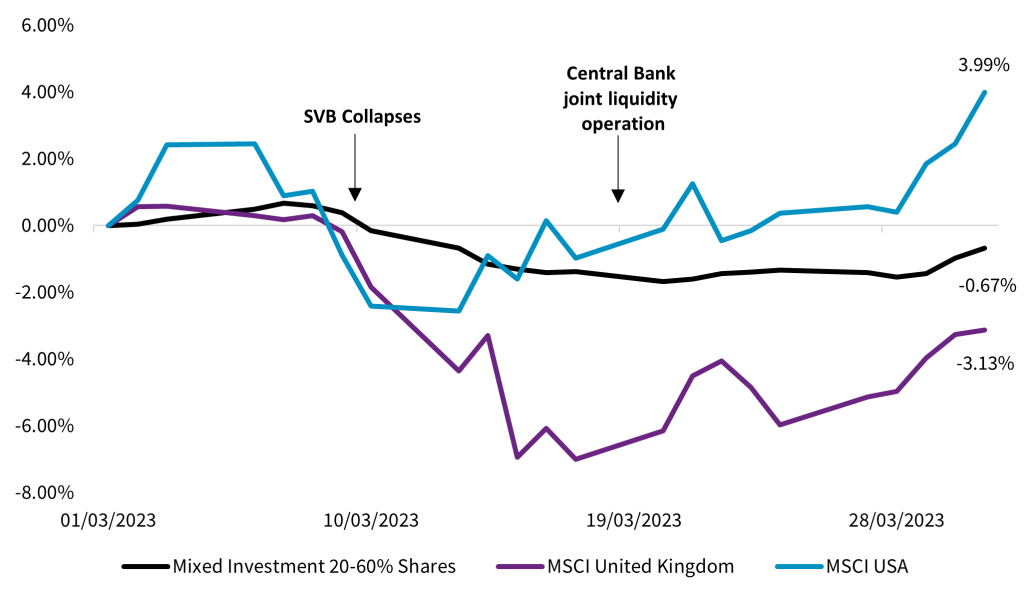

Markets encountered ‘bank-induced’ volatility in March, with the comparison benchmark for most Balanced portfolios down by 0.67%, despite starting the month with the same gain. Key events were the collapse of Silicon Valley Bank (SVB) and the resultant provision of liquidity by the major central banks which provided a much-needed boost to markets.

SVB was different in its approach, compared to the banking majors, as its business model depended on taking in deposits and investing them in a range of bonds to generate profit from the difference in interest rates. The liquidity challenge came when the bank continued to operate the model deep into the interest rate hiking cycle, which impaired the value of the bond investments on SVB’s books.

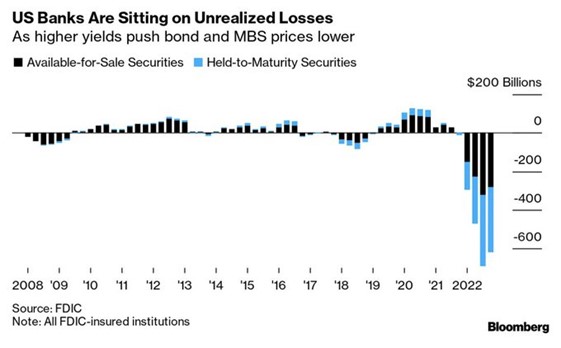

The key inflection point was when many corporate savers requested access to their funds, which SVB struggled to keep pace with as the deposit value was effectively tied up in mid and long-term bonds, without easy access to capital. At the time of writing, US banks were sitting on c.$600bn in unrealised losses in Held to Maturity (HTM) accounts (bond investments), as shown on the following chart:

Source: Bloomberg, 31/03/2023.

In the aftermath of the SVB collapse, the US Federal Reserve (the Fed) will now allow banks in a similar position to borrow against the face value of their government bonds and Mortgage-Backed Securities, increasing access to liquidity and avoiding a ‘fire-sale’ of assets.

167-year-old bank, Credit Suisse, faced the same fate as SVB after UBS took over its Swiss counterpart. Credit Suisse faced a variety of issues which began long before the events in the US – they reported problems with their accounting process, their London-listed share price was down over 95% since 2018, and their shareholders confirmed they would not be prepared to provide additional liquidity to the bank. In particular, the CEO of the Saudi Arabia Bank said that he would “absolutely not” increase the bank’s stake in Credit Suisse, which helped to drive Credit Suisse’s share price to an all-time-low and cause a surge in the cost of insuring its debt.

OPEC+ cut oil production on 2nd April 2023 in a surprise move which caused the West Texas Intermediate (WTI) oil price to close 6.27% higher the following day, settling at around the $80 per barrel. The cut equated to 3.70% of global demand, which the US National Security Council called “inadvisable” as lower prices are necessary for curbing inflation and to support economic growth.

Business sentiment remained positive in the US and UK with composite Purchase Manager Indices (PMI) readings of 52.3 and 52.2 respectively (50+ signalling growth). The US reading was underpinned by steeper increase in service sector growth, whilst manufacturing remained in contraction – reporting a reading of 49.2.

In the UK, new business volumes increased at the fastest pace since April 2022. On the price front, input cost inflation was the lowest since April 2021 and prices charged inflation was also the weakest for just under two years.

Market Performance.

In a month of mixed messages, Europe fared relatively well again in March, with Portugal and Denmark returning 4.60% and 3.51% respectively, whilst Singapore returned 2.16% (the 3rd highest performer of the developed markets). Interestingly, the other end of the spectrum was mirrored in geographical terms with Hong Kong, Norway, and Austria returning -4.16%, -6.96%, and -10.75% respectively.

Despite volatility, the MSCI USA index returned 0.97%, whilst its UK counterpart posted a 3.13% loss.

Most Emerging Market nations finished in the red’ with only Korea (1.80%), Saudi Arabia (1.66%), and Indonesia (0.54%) indices producing positive returns out of 24 nations. The laggards were Greece (-9.74%), Egypt (-10.25%), and Turkey (-11.07%).

Sector and Index Performance.

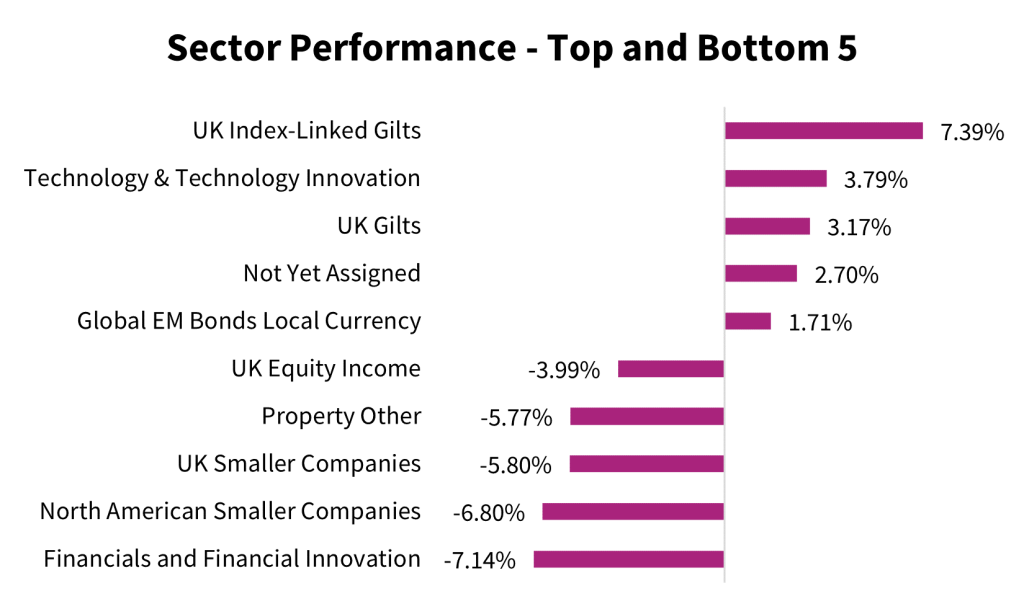

Source: FE FundInfo, 01/04/2023.

March was the month of Index-Linked Gilts, which returned 7.39%. However, this is a sign of recovery rather than a continued trend, since the sector remains down 25.10% over the last year. Some of the recovery may be driven by the bond market belief that central banks will soon ‘pause’ or ‘pivot’ the interest rate hiking cycle.

Understandably, it was a tough month for the Financials and Financial Innovation sector in view of the exposure of liquidity issues across several US and European banks. The key support in place by the central banks shows that the next step is not a test of liquidity, but a test of solvency.

One thing is for sure; the phrase “Don’t fight the Fed” stands the test of time. There is strong correlation between the expansion of central banking liquidity & balance sheets and the direction of the stock market.

Source: FE FundInfo, 01/04/2023.

Summary.

The March banking crisis was addressed quickly thanks to large-scale and widespread support by central banks. Whether the support package on offer is sufficient remains to be seen, as banks now face a test of solvency as well as liquidity.

Oil prices rose in the face of lower supply which could hamper efforts to lower inflation. What happens in the coming months will largely be a function of central banking activity along with the actions of those driving energy prices.

Sources: Anthony Walters – Head of ESG at Clever Adviser Technology Ltd (Clever), FE FundInfo – 01/04/2023, Bloomberg – 31/03/2023, Reuters – 13/03/2023, Google Finance – 06/04/2023, MSN – 27/03/2023, Reuters – 02/04/2023, Markit Economics/Tradingeconomics.com – 06/04/2023.

Important Information: This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Clever to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. You should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine – together with your own professional advisers if appropriate – if any investment mentioned herein is believed to be suitable. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice.

All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Issued by Clever Adviser Technology Ltd (Clever), a company registered in England and Wales (company number: 2910523) with registered office at Watergate House, 85 Watergate Street, Chester, Cheshire CH1 2LF.

CleverAdviser

CleverAdviser