Welcome to the Chart of the Week.

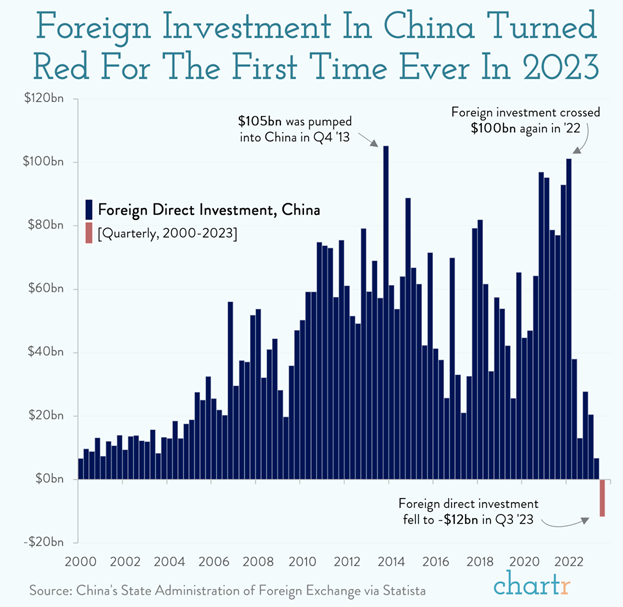

The Chart of the Week highlights that foreign investor flows into China turned negative for the first time in 2023. China’s economy faces several headwinds: weaker economic growth, a crisis in the property sector, and deflation.

The country is also contending with weaker overseas demand because of the trend of nearshoring, where companies bring production closer to home. This was demonstrated in July last year when Mexico overtook China as the US’s largest trading partner.

This year, we have seen stimulus measures announced. China’s central bank cut its reserve requirements, allowing banks to lend more money rather than holding it on their balance sheets.

Other measures introduced this year include restrictions on short selling and consolidation of the banking industry by merging small rural lenders into larger banks, intending to reduce the likelihood of financial stress.

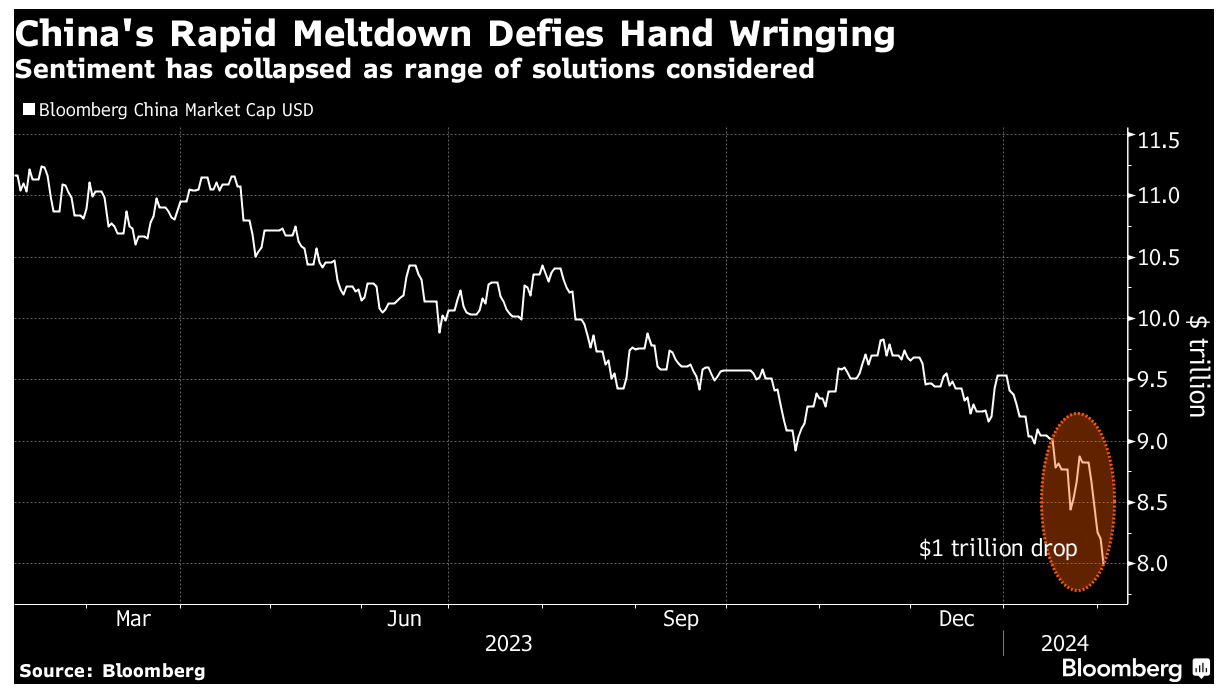

China’s economic stimulus measures have so far failed to reassure markets, with investors seeing them as too small and insufficiently targeted.

However, we believe this support will eventually feed through into the economic data and that the measures announced already this year signal Beijing’s intentions to ramp up policy support.

However, in the absence of bazooka-style stimulus measures, markets will need to see this support being sustained on a continuing basis.

It is worth emphasising that China is the second-largest economy in the world, so this is an equity market that investors cannot ignore.

China is home to many innovative companies, especially in technology and areas related to clean energy, such as solar power, electric vehicles and batteries. One Chinese company to which we have exposure in our portfolios is BYD, which recently overtook Tesla as the world’s largest electric vehicle manufacturer. Businesses like this demonstrate the enormous potential of the Chinese economy and the growing ambition of the nation’s companies to compete on a global scale.

While China’s economy and its equity markets face headwinds in the Year of the Dragon, few can doubt the potential of this economic powerhouse to reach new heights over the long term.

Takeaway: Pessimism brings opportunity.

Did you know: Danish drugmaker Novo Nordisk has been “surprised” by the readiness of European consumers to pay for weight-loss drugs from their own pockets, as the region’s largest company invests in new supply to meet runaway demand. Click here.

Marlborough Podcast: This week, we discuss interest-rate cut concerns, earnings season and declining oil prices. Click here.

CleverAdviser

CleverAdviser