Bullish November for Bonds and Equities as Inflation continues to fall

- Manufacturing and Services continue to improve

- Egypt rallies in Emerging Markets

- China/Greater China faces challenges

November was a bullish month for the Balanced portfolio benchmark, which returned 3.57%, as bonds and equities rallied. The driver behind the latest rally was better than expected inflation data as concerns about contagion from conflict in the Middle East continue to dissipate.

Meanwhile, inflation continues to fall across the world as the effects of interest rate rises continue to be felt.

Inflation and Interest rates.

Bank of England

UK inflation currently sits at 4.60% and the central bank is keen to remind markets that there is further to go in order to normalise rates. Bank of England Governor Andrew Bailey said getting inflation down to the central bank’s 2.00% target will be “hard work” as most of its recent fall was due to the unwinding of the jump in energy costs last year. “The rest of it has to be done by policy and monetary policy” Bailey said in a November interview. “And policy is operating in what I call a restrictive way at the moment – it is restricting the economy”.

US Federal Reserve

US inflation fell to 3.10% in November, down from 3.20% prior, whilst core inflation remained steady at 4.00%. It is the level of Core inflation that causes the Federal Reserve to take a cautious approach to monetary policy, with Chair Jay Powell recently stating, “It would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so”.

European Central Bank

Eurozone inflation fell by more than expected for a third straight month in November, challenging the European Central Bank’s narrative that price growth is stubborn. Inflation has dropped quickly towards the ECB’s 2.00% target from levels above 10.00% just a year ago but policymakers have cautioned against excessive optimism. They warn that the “last mile” of disinflation could be more difficult and take twice as long as getting back under 3.00%.

Despite this, a series of underwhelming data continues to come from the region, which is driving traders to bet that the ECB will be the first central bank to cut interest rates next year.

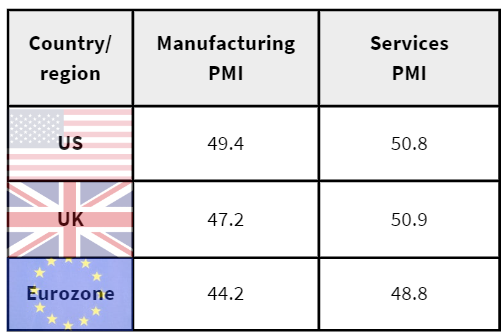

Note: Less than 50 PMI = contraction and more than 50 PMI = growth

Manufacturing

Again, manufacturing confidence remains in contraction, with all three regions reporting negative growth for the month although the US is the closest to reporting growth once more.

The Eurozone figures were revised slightly higher to 44.2 in November 2023, up from 43.1 in October and the highest since May 2023. However, the most recent reading still indicated a seventeenth consecutive month of contraction in the bloc’s manufacturing sector, with Austria leading the decline, closely followed by Germany and France. This gives markets hope that the European Central Bank will be the first to cut interest rates next year to boost economic growth.

Services

Both the US and UK are reporting growth in services, whilst the EU remains in a shallow services contraction.

The US reading was the highest in four months, as output and new business expanded. Customer demand strengthened on the month, as new business from abroad also ticked up.

In the UK, services expanded as the latest PMI reading indicated an expansion in sector activity for the first time since July 2023, attributed to increasing demand and the completion of unfinished projects. Backlogs of work continued to decrease for the sixth consecutive month, declining at the fastest rate since August 2023.

Market performance.

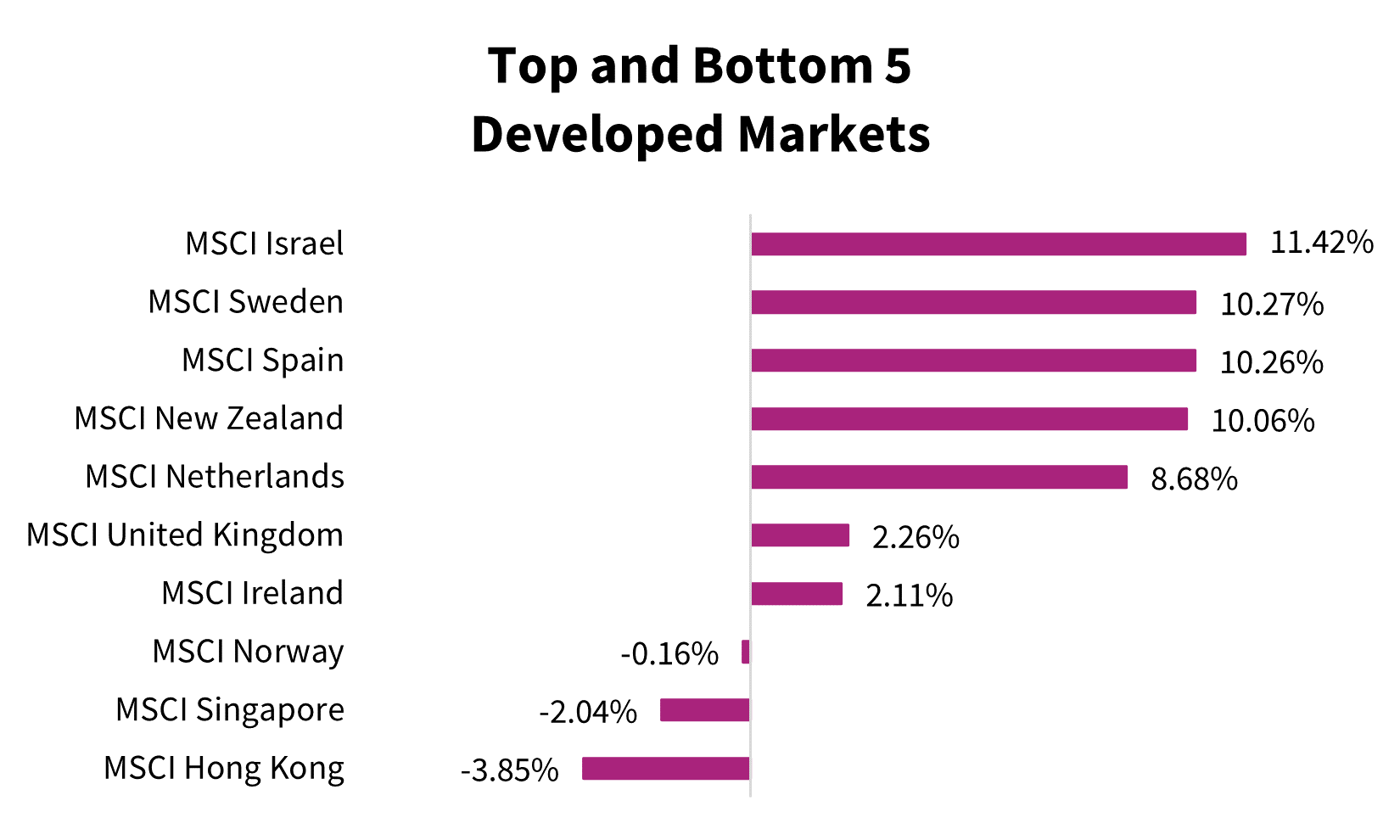

All bar three Developed Markets were positive this month, with Israel predictably topping the table as the ETF begins to recover from its earlier move, caused by conflict in the region.

The Hong Kong index was the laggard for this month, with Sun Hung Kai Properties Ltd falling by almost 5.50% as the real estate sector continues to face major challenges in the China/Greater China region.

The UK index made an appearance in the bottom five with a return of 2.26% as energy receded for the month on demand issues and caused by slowing global growth.

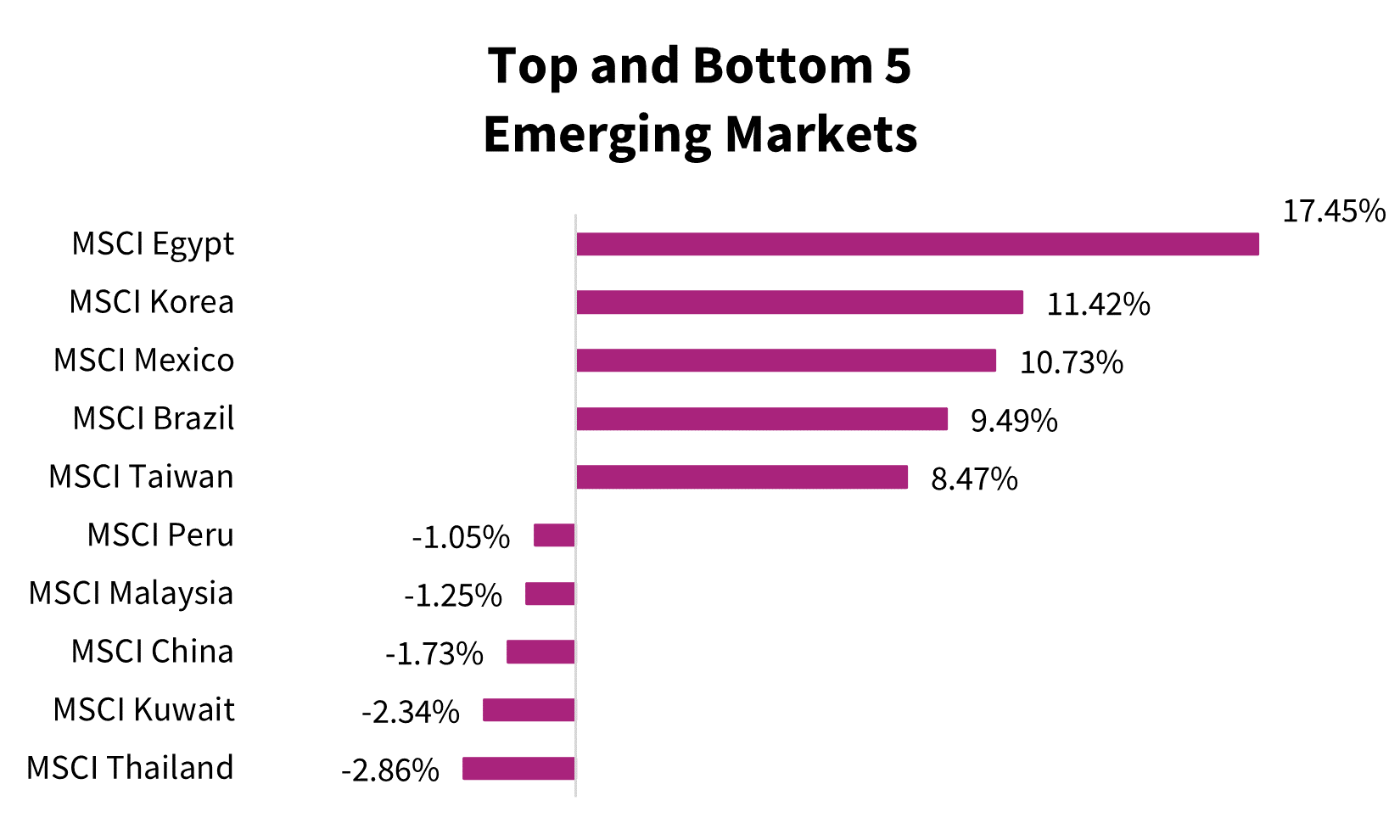

Egypt pressed ahead in Emerging Markets with a return of over 17.00%. This was mostly driven by the performance of Commercial International Bank, which comprises 81.00% of the index, as said in previous market reviews.

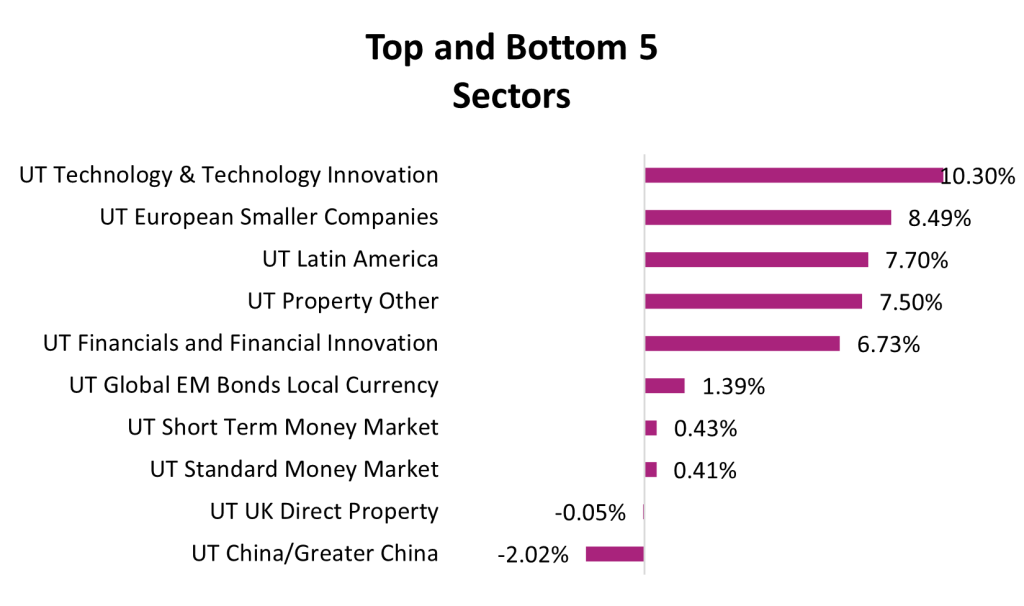

Sector performance.

Presenting a similar pattern to that seen in markets, all bar two sectors produced a positive return this month. The sectors were led by Tech, which continues to outperform for the year. European Smaller Companies also fared well whilst China/Greater China was the only region-specific sector to produce a negative return for the month, on continued challenges of slower economic growth and shrinking liquidity in the property sector.

Source: FE FundInfo, 14/11/23

Source: FE FundInfo, 14/11/23

Summary.

Markets did indeed climb the ‘wall of worry’ in November as it quickly shrugged off the conflict in the Middle East and any signs of contagion.

It was a good month for Balanced portfolio investors, who benefitted from the dual rally in Bonds and Equity, on growing optimism that central banks will cut interest rates next year, despite insistence from central banks that we should prepare for ‘higher rates for longer’.

This month seems like the first one in a while to cap off briefly as markets performed exactly as we all hoped they would.

Download

Author: Anthony Walters – Head of ESG at Clever Adviser Technology Ltd (Clever)

Sources:

Economic indicators information from The Institute for Supply Management – Report on business, IHS Markit and Trading Economics

The ‘Balanced Portfolio Benchmark’ is the UT Mixed Investment 20-60% Shares Sector.

Market and Sector performance data sourced from FE FundInfo, 13/11/23

European Central Bank holds interest rates steady after 10 consecutive hikes by Jenni Reid, CNBC, 26/10/23

Pound rises against dollar as Bank of England expected to cut interest rates by May, By LaToya Harding, Yahoo Finance UK, 13/11/23

BoE’s Pill says pay growth is slowing but still too high, by Reuters, 14/11/23

Powell calls Fed policy ‘restrictive,’ but keeping options open, by Jennifer Schonberger, 09/11/23

Important Information:

This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Clever to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. You should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine – together with your own professional advisers if appropriate – if any investment mentioned herein is believed to be suitable. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice.

All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Issued by Clever Adviser Technology Ltd (Clever), a company registered in England and Wales (company number: 2910523) with registered office at Watergate House, 85 Watergate Street, Chester, Cheshire CH1 2LF.

[/vc_column_text][/vc_column][/vc_row]

CleverAdviser

CleverAdviser