Written by Anthony Walters, Clever’s Head of ESG, this monthly market review offers insights into the most notable and impactful events in global financial markets over the last month.

- Second largest bank failure in US history

- Lower inflation in the US, whilst Europe remains higher

- Oil price at lowest level since 2021

It was a positive month for markets, with the Balanced portfolio benchmark up 0.52%. Continuing the trend from last month, another US bank collapsed at the end of April (First Republic), although one could barely tell by looking at the market. What happens is important, but how the market reacts is far more important.

Why did the market react so calmly to the second largest banking failure in US history? Action taken by central banks to guarantee deposits means that, for most people, the chance of losing money as a result of a bank collapsing is greatly reduced.

As for the liquidity provided to banks themselves; it is the equivalent of knowing that your parents (central banks) will always bail you (retail banks) out, regardless of what you do with your money.

Economic data remained strong with the US, Eurozone, and UK’s leading economic indicators (Composite Purchase Managers Index or ‘PMIs’) continuing to grow and remaining in ‘expansion’ territory.

In the UK, growth was solely driven by the services sector with new sales rising to a 13-month high, which offset the ninth consecutive month of contraction for the manufacturing sector.

Inflation and interest rates.

Inflation continues to trend lower in the US, with the annual rate slowing to 5% – the lowest since May 2021. The same cannot be said for the UK (10.1%) and Eurozone (7%) however, with the UK missing expectations for a lower reading. The cost of food and non-alcoholic beverages continued to rise in the UK, with inflation in this category coming in at 19.1% v 18% in February.

Federal Reserve Chair, Jay Powell, stated that the US is: “much closer to the end of this (rate hiking) than to the beginning” adding that: “If you add up all the tightening that’s going on through various channels, we feel like we’re getting close or maybe even there”.

The UK and Europe face a different challenge however, with the Bank of England still expecting inflation to fall sharply by the end of the year, whilst also reserving the right to raise interest rates further if required. On 23rd April, the Bank of England meeting minutes said “If there were to be evidence of more persistent pressures, then further tightening in monetary policy would be required”.

Meanwhile the European Central Bank’s governing council is warning that inflation continues to be “too high, for too long”, but they “will continue to follow a data-dependent approach to determining the appropriate level and duration of restriction”.

Market performance.

Europe led developed markets again this month with Switzerland, Austria, and the UK returning 4.49%, 3.79%, and 3.60% respectively. Meanwhile, Singapore, The Netherlands, and Israel sat firmly at the bottom of the results table, returning -2.30%, -2.93% and -3.47% respectively.

It was a big month for Poland in emerging markets, with the index returning 11.65%. Hungary returned 8.10%, whilst the United Arab Emirates returned 7.69%.

The MSCI USA index returned -0.41%, while Taiwan (-5.81%), Turkey (-6.68%) and China (-6.70%) were less fortunate.

Sector performance.

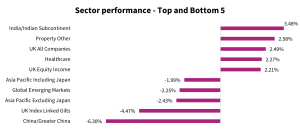

‘India/Indian Subcontinent’ led sector performance for the month at 3.48%, followed by ‘Property’ with 2.98%, and ‘UK All Companies’ in third place at 2.49%. Although ‘India/Indian Subcontinent’ flourished this month, performance was a sign of short-term recovery rather than a change in trend as this sector remains the third worst performer on a year-to-date basis.

‘Asia Pacific Excluding Japan’ (-2.43%), ‘UK Index Linked Gilts’ (-4.47%), and ‘China/Greater China’ (-6.30%) all had a relatively poor month, with the ‘China/Greater China’ sector also being the worst year-to-date performer of all 44 sectors.

Despite New Year optimism and positive performance in January, the grand Chinese re-opening from Coronavirus lockdowns is not feeding through to investment performance, with all funds in the sector now down for the year (ranging from -2% to -10%).

Data Source: FE FundInfo, 03/05/2023

Data Source: FE FundInfo, 03/05/2023

Summary.

The second largest banking failure in US history failed to unnerve markets, as investors remained confident about the prospects for future growth – especially after the market already discounted a slowdown in economic growth.

Economic data remains strong, but the question is whether it is strong enough to continue to fuel inflation. Speaking of fuel; the April spike in oil prices after OPEC+ lowered production proved to be a false start, with oil now trading close to $70 per barrel, a price not seen since December 2021.

Sources: Anthony Walters – Head of ESG at Clever Adviser Technology Ltd (Clever). FE FundInfo via FE Analytics, May 2023. Markit Economics, United Kingdom Composite PMI Summary. Markit Economics, US Bureau of Labor Statistics, United States Inflation Rate Summary. Markit Economics, Office for National Statistics, United Kingdom Inflation Rate Summary. Markit Economics, Euro Area Inflation Rate Summary. Bank of England raises interest rates to 4.25% despite banking turmoil, Delphine Strauss and Oliver Ralph – FT.com, Monetary Policy Statement, Frankfurt am Main – European Central Bank, 4 May 2023.Investing.com, Crude Oil WTI.

Important Information: This document is a general communication being provided for informational purposes only. It is educational in nature and not designed to be taken as advice or a recommendation for any specific investment product, strategy, plan feature or other purpose in any jurisdiction, nor is it a commitment from Clever to participate in any of the transactions mentioned herein. Any examples used are generic, hypothetical and for illustration purposes only. This material does not contain sufficient information to support an investment decision and it should not be relied upon by you in evaluating the merits of investing in any securities or products. You should make an independent assessment of the legal, regulatory, tax, credit, and accounting implications and determine – together with your own professional advisers if appropriate – if any investment mentioned herein is believed to be suitable. Investors should ensure that they obtain all available relevant information before making any investment. Any forecasts, figures, opinions or investment techniques and strategies set out are for information purposes only, based on certain assumptions and current market conditions and are subject to change without prior notice.

All information presented herein is considered to be accurate at the time of production, but no warranty of accuracy is given and no liability in respect of any error or omission is accepted. Issued by Clever Adviser Technology Ltd (Clever), a company registered in England and Wales (company number: 2910523) with registered office at Watergate House, 85 Watergate Street, Chester, Cheshire CH1 2LF.

CleverAdviser

CleverAdviser